Money is more than just currency – it is a feeling, a story, and for many, even a source of identity. Although financial advice often focuses on budget, savings schemes, and investments, our monetary options are not the real mathematics of the driver – this is psychology.

Think about it: Two people with the same income can live completely different financial lives. One can build a stable savings account and feel secure, while the other struggles with a loan despite having good earnings. The difference is often inherent in mentality, habits, and how each person is emotionally linked to money.

Why Money Is Emotional, Not Just Rational

On paper, it seems easy to manage money: Earn, use wisely, save, and invest. But in real life, things are rarely so straightforward.

For some, expenses bring excitement- after a long day as a reward, or a way to feel that they control their life, which is stressful. For others, it creates a close-to-money sense of safety and stability. These reactions are not random; They take shape from personal history, culture, and upbringing.

- If you have grown up in a house where the money was tight, you can take a sense of anxiety or guilt every time you use.

- If the money were always available, you could view it as a form of freedom, expression, or even a status.

Over time, these hidden faiths become habits. And habits – whether we notice them or not – shape every financial decision we make.

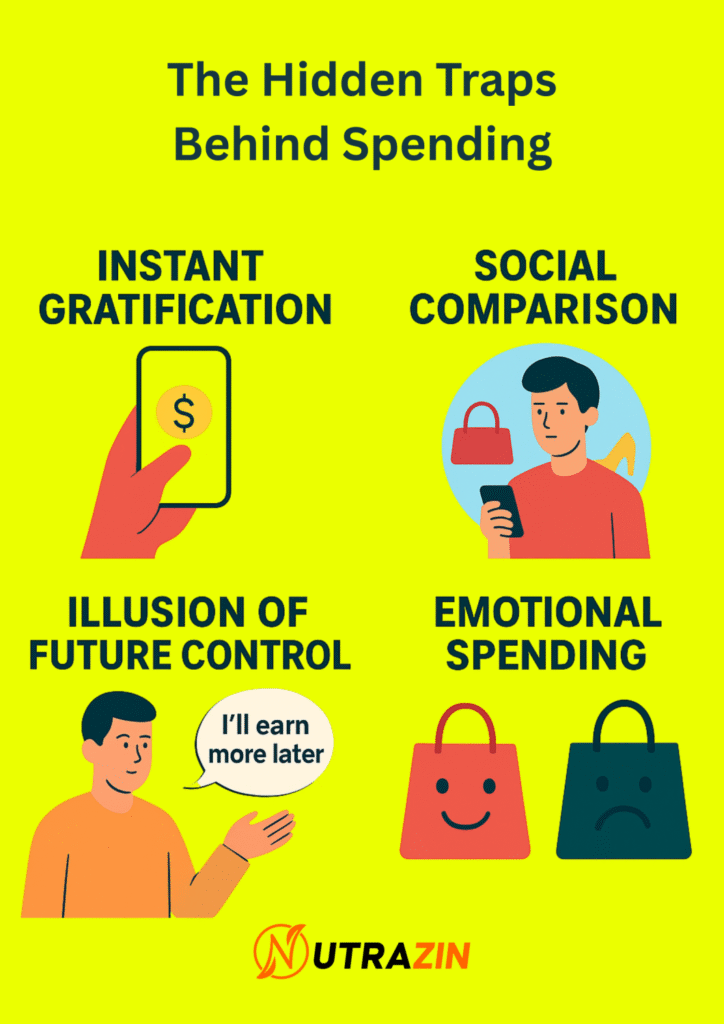

The Hidden Traps Behind Spending

Even the most disciplined people fall into a psychological trap. Recognizing them is the first step toward breaking free.

1. Immediate satisfaction

Our minds like quick rewards. This is why a new phone or an impulsive online purchase feels exciting at the moment, even if it delays your savings goals. Marketers know this, and the design offers to trigger the “limited time” for the exact response.

2. Social comparison

Scrolling through Instagram or LinkedIn can make us feel that all the other people live a more glamorous life. This comparison often drives unnecessary expenses – not because we want the item, but because we don’t want to feel left behind.

3. The Illusion of Future Control

“I’ll save more once I get a raise.” Sounds familiar? Many people overspend today, assuming tomorrow will fix it. Optimism is good, but overconfidence can cause long-lasting financial strain.

4. Emotional Spending

Shopping when stressed, bored, or even celebrating is more common than we admit. However, when expenses can temporarily lift the mood, satisfaction often fades quickly – leaving regret (and Bill) behind.

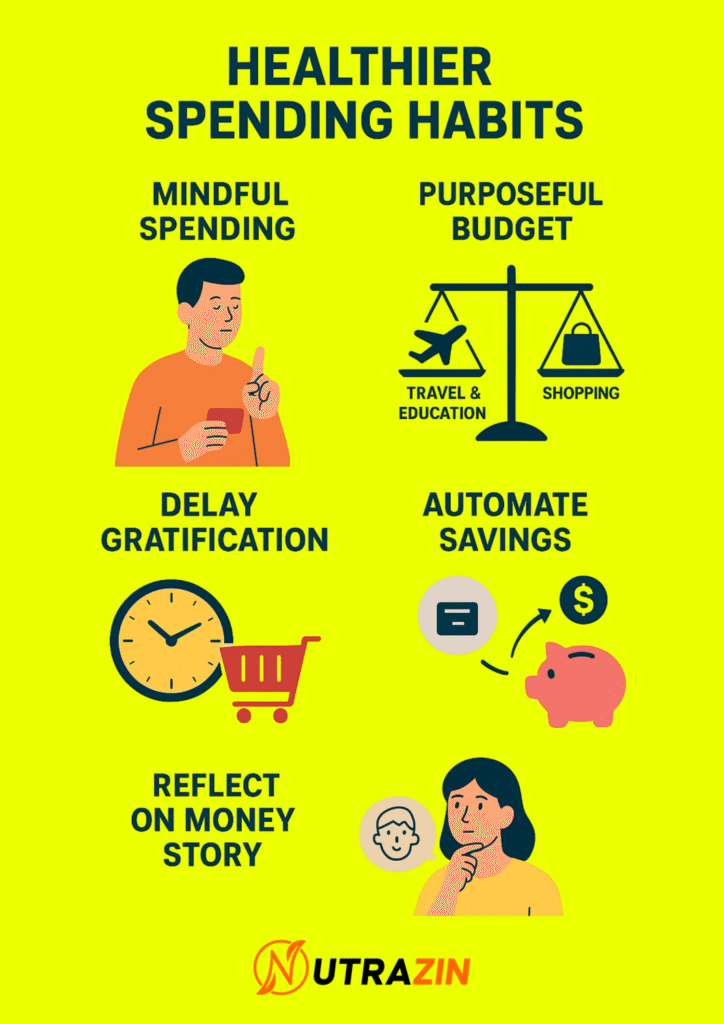

Building Healthier Spending Habits

Encouraging part? When you become aware of your money psychology, you can rewire your habits. Small changes can cause permanent economic stability.

Practice Mindful Spending:

Before you shop, stop and ask: Do I need it? Will it matter in a month? The reflection moment helps to reduce impulse.

Create a values-based budget:

There are no budget restrictions – they are about adjustment. If travel motivates you more than shopping, you allocate money there. Spending in line with your values feels rewarding, not limiting.

Delay Gratification:

Try a 24-hour rule for non-essential items. If you still want it the next day, it may be worth buying. If not, you have saved yourself from regret.

Automated savings:

Treat savings like rent- it’s non-negotiable. By establishing automated transfers, you remove dependence on willpower and build financial security effortlessly.

Understand your money story.

Reflect on your past: What did I learn about money growing up? Do I repeat the pattern that catches me back? Self-awareness can change life habits.

Final thoughts

The psychology of money reminds us that financial well-being is not just about income-it is about awareness, mentality, and daily choices. When we recognize the emotional trigger behind our expenses, we get the power to change them.

The true wealth is not how much you earn, but how you can do what you already are. By switching the impulse habits for the mindful ones, the money becomes more than the source of stress – it becomes a tool for freedom, safety, and security.